EXEO Residences

Overview

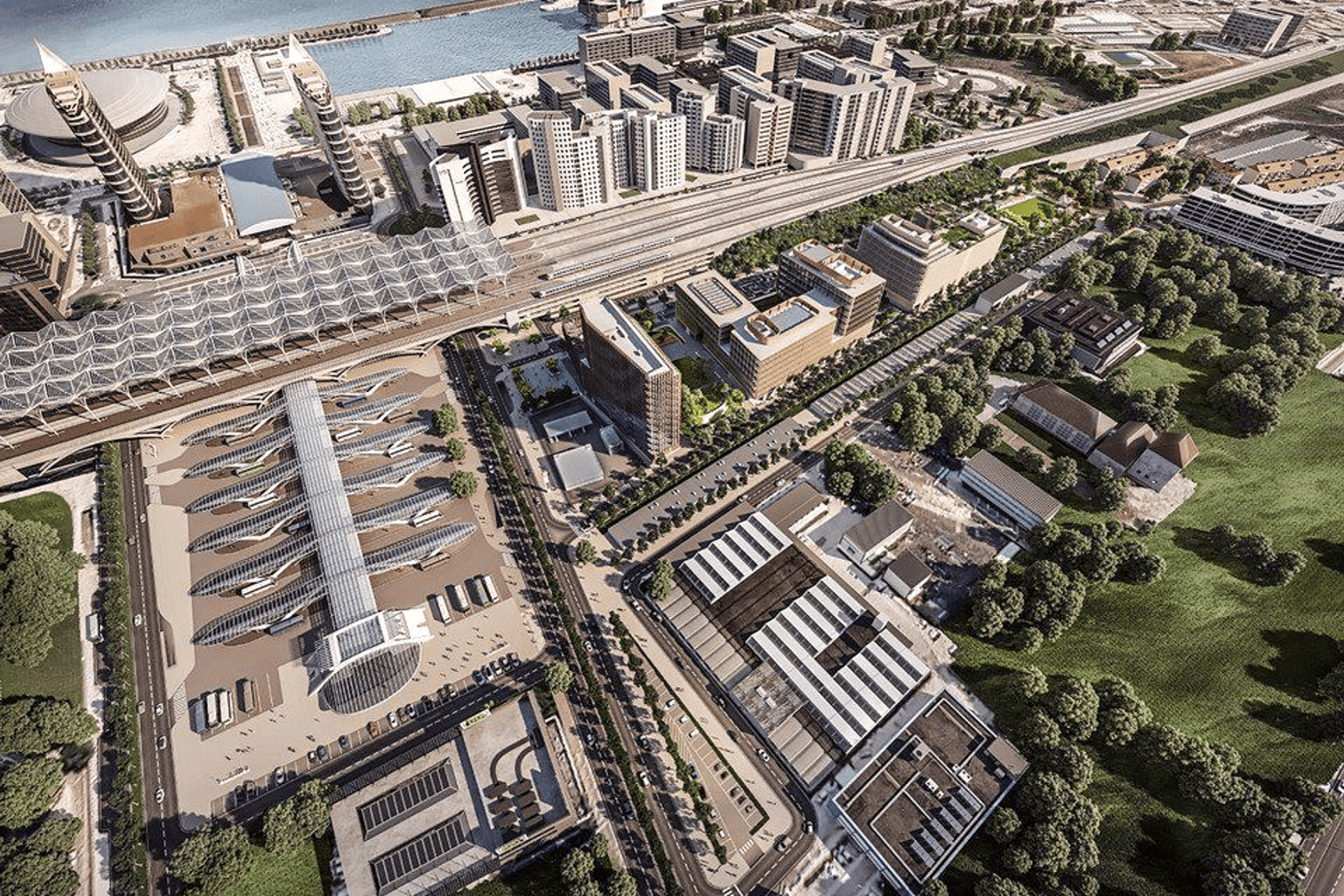

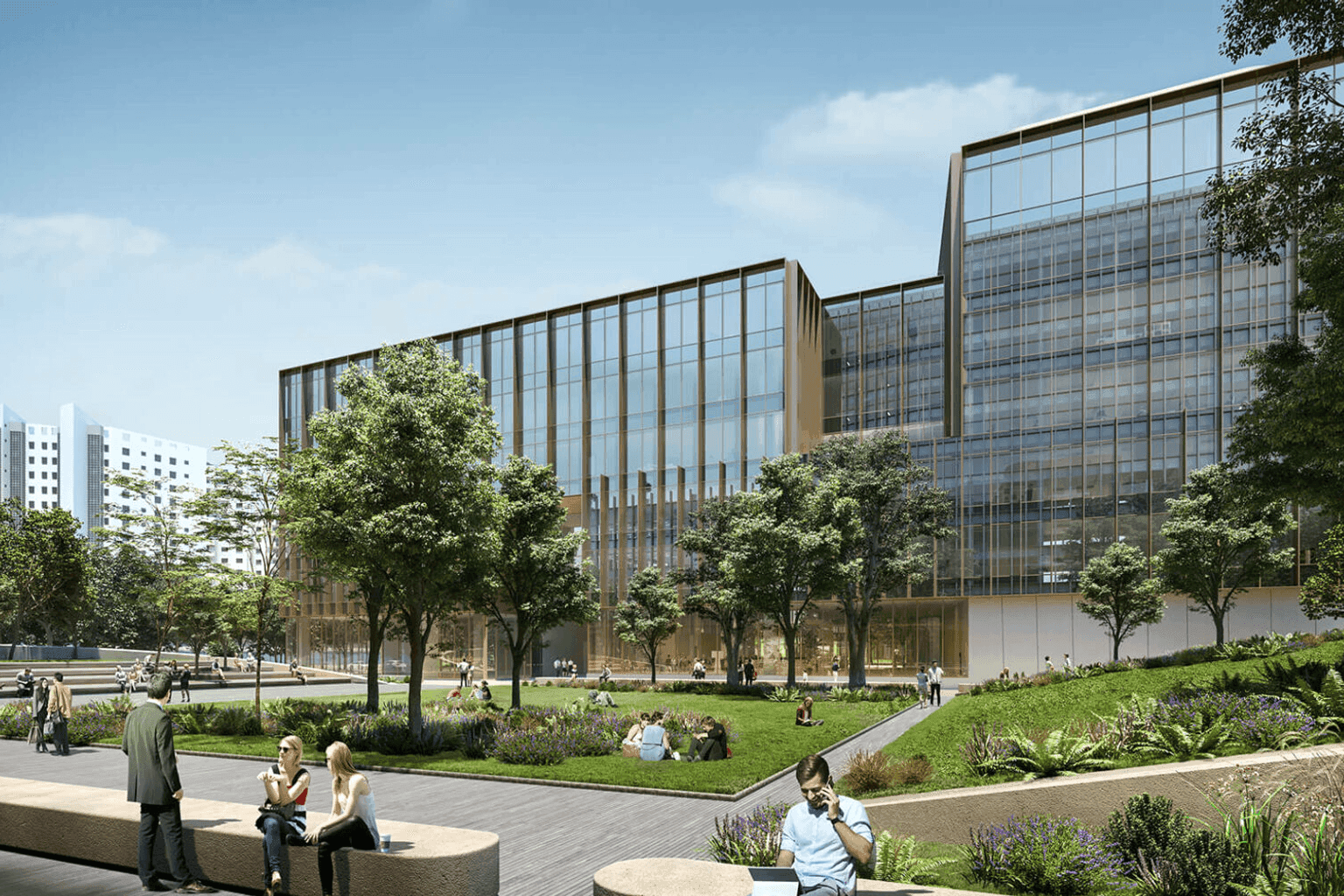

A three-tower project in Lisbon's Expo business zone, with one residential and two office towers.

High demand! This property is getting a lot of attention.

Consider acting fast if you're interested.

Building/Community Amenities

- 24/7 Security

- Balcony / Patio / Terrace

- Fitness Center / Gym

- Garden / Courtyard

- Parking

- Pool

Investment Insights

Legal & Ownership

Legal & Ownership Information

Ownership Structure

Ownership Rights

Full ownership rights (Freehold)

Foreign Ownership

No restrictions for foreign buyers.

Tax Considerations

Property Taxes

Annual Municipal Property Tax (IMI) of 0.3-0.8% of tax value. Non-resident income tax of 28% on rental income.

Transfer Tax

Property Transfer Tax (IMT) ranges from 0-8% depending on property value and type.

Inheritance Tax

Stamp duty of 10% on inheritance (spouses, descendants, and ascendants are exempt).

Important Considerations

Restrictions

- Additional requirements for rural properties

Required Documents

- Tax identification number (NIF)

- Public deed of purchase

- Land registry certificate

- Payment proof of IMT and stamp duty

Financing Options

Financing Options

Financing in Portugal

Portuguese banks offer competitive mortgage products to foreign buyers. Non-residents can typically secure up to 70% of the property value, with terms up to 30 years (age-dependent).

Requirements for Foreign Buyers

- 1Valid identification and Portuguese tax number (NIF)

- 2Proof of income (tax returns, pay slips)

- 3Bank statements for the last 6 months

- 4Property evaluation report